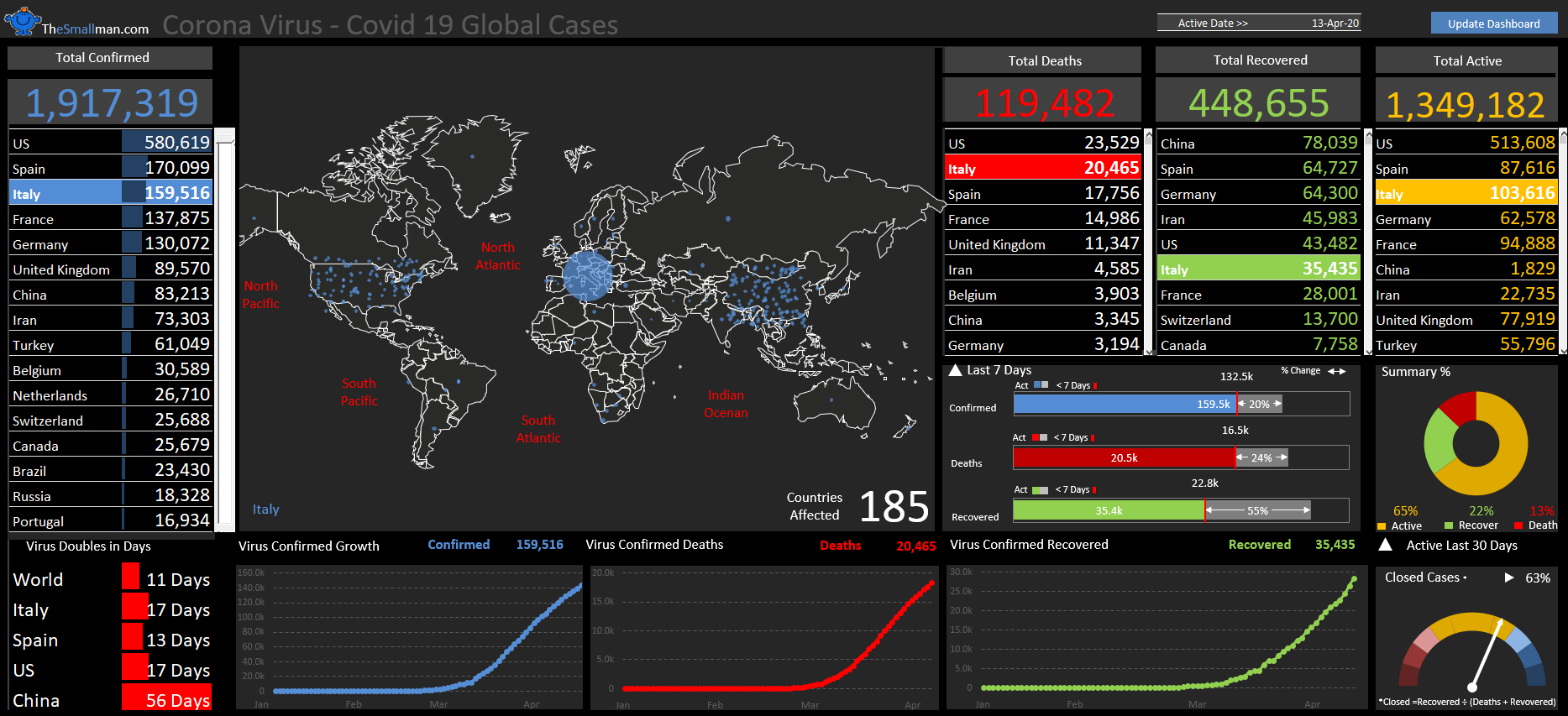

The gradual rise in prices is known as inflation. Macroeconomically speaking, it is the result of excess demand, which raises prices. This should eventually encourage a larger supply of those goods and services, restoring supply and demand balance.

A financial model often estimates the financial results for a single company within the broader economy, focussing on microeconomic difficulties. Individual enterprises are affected by inflation even though they have no control over it. It has an effect on costs, the company will pay suppliers more, as well as revenue, inflation influences how a corporation sets prices.

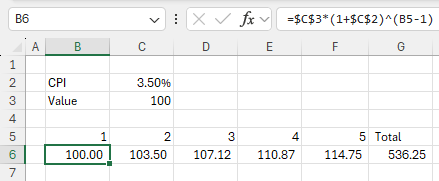

Adding inflation can be done over multiple cells like in the following example.

We can see that our inflation rate is 3.5%, the escalating value is $100.

The formula is:

Value * (1 + CPI) ^ (Periods - 1)

=$C$3*(1+$C$2)^(B5-1)

This is copied from B6 to F6 to give a neat 6 cell solution. However, what if we want to see the calculation in a single cell. This is a little more complex however

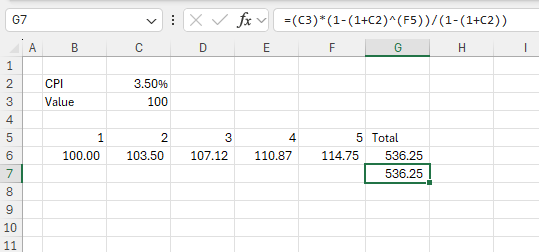

Value * (1 - (1 + CPI) ^ (Total Periods)) / (1 - (1 + CPI)

=(C3)*(1-(1+C2)^(F5))/(1-(1+C2))

The following shows how this formula works in practice.

Note the formula produces the same result as doing it long hand. It is an elegant solution to a common problem.